Premium Meat Industry Machinery Durable & Efficient Solutions

- The Evolution and Impact of Meat Industry Machinery

- Breakthrough Technological Advancements in Modern Meat Machinery

- Comparative Analysis of Leading Meat Machinery Manufacturers

- Tailored Solutions for Diverse Production Requirements

- Success Stories: Implementation in Various Industry Segments

- Navigating Regulatory Compliance and Safety Standards

- Investing in the Future of Equipment Used in the Meat Industry

(meat industry machinery)

The Evolution and Impact of Meat Industry Machinery

Global meat consumption has surged by 27% since 2010, reaching 328 million metric tons annually. This demand fuels a $15.7 billion meat processing equipment market projected to grow at 5.3% CAGR through 2030. Modern meat industry machinery

revolutionized processing from manual operations to automated systems capable of handling 10,000 kg/hour throughputs. Particularly transformative has been the industry meat mincer, evolving from basic manual grinders to computer-controlled units with particle size accuracy within 0.5mm tolerance. Contemporary production lines integrate multiple processing stages - from stunning systems and dehairing machines to portioning robots and vacuum packaging units - all monitored through centralized SCADA systems. This integration reduces labor requirements by up to 65% while increasing yield efficiency. The technological shift enables facilities to process 30-50% more volume without physical expansion.

Breakthrough Technological Advancements in Modern Meat Machinery

Precision engineering defines next-generation equipment used in meat industry applications. Variable frequency drives (VFDs) allow speed adjustments within ±0.1 RPM accuracy, essential for maintaining product texture integrity during grinding and mixing operations. Advanced automation now incorporates AI vision systems performing real-time quality inspections at 200 frames per second, automatically rejecting products failing USDA standards. Hygienic design improvements feature seamless welds exceeding 1.6μm Ra surface roughness to prevent bacterial colonization. Industry leaders implement IoT sensors tracking operational parameters including pressure (up to 10,000 psi monitoring), temperature (±0.5°C accuracy), and blade wear for predictive maintenance notifications. Modern industry meat mincer technology delivers energy consumption reductions of 15-20% through servo motor designs. Manufacturers are transitioning to materials like AISI 316L stainless steel and FDA-compliant polymers capable of withstanding daily high-pressure washdown cycles lasting up to 30 minutes at 85°C.

Comparative Analysis of Leading Meat Machinery Manufacturers

| Manufacturer | Throughput Capacity | Energy Efficiency | Customization Options | Maintenance Intervals | Cost Index |

|---|---|---|---|---|---|

| Techmeat Solutions | 8,500 kg/h | 2.8 kWh/ton | 94% components configurable | 650 operating hours | 1.00 |

| MeatPro Systems | 7,200 kg/h | 3.5 kWh/ton | 68% components configurable | 500 operating hours | 0.87 |

| Global Carnitech | 9,100 kg/h | 3.2 kWh/ton | 82% components configurable | 550 operating hours | 1.12 |

| Protein Processing Inc. | 6,400 kg/h | 4.1 kWh/ton | 57% components configurable | 480 operating hours | 0.75 |

Techmeat Solutions dominates high-throughput scenarios with modular designs allowing production line reconfiguration within 36 hours. Their proprietary grinding technology delivers consistent particle distribution, evidenced by 98.3% conformity in independent texture analysis. However, MeatPro Systems provides superior entry-level pricing with 27% lower ownership costs during the first five years. Global Carnitech offers the industry's only integrated blockchain tracking with machinery sensors automatically logging USDA compliance data directly to distributed ledgers.

Tailored Solutions for Diverse Production Requirements

Successful meat industry machinery integration requires extensive customization aligned with specific operational parameters. Facilities processing religious-compliant products require dedicated production lines constructed under rabbinical or halal supervision, incorporating specialized blade designs and cleansing protocols. Regional regulatory variations impact specifications, with EU installations requiring additional guarding to meet Machinery Directive 2006/42/EC. Climate factors necessitate adaptation - equipment deployed in tropical regions typically requires 30-40% greater cooling capacity to maintain optimal temperatures. Leading providers now implement digital twin modeling before construction, creating virtual prototypes that simulate operational dynamics under various scenarios. These simulations accurately predict bottlenecks and throughput limitations with 94% precision, saving an average $215,000 in post-installation modifications per project. Custom grinder configurations for alternative protein production incorporate specialized augers maintaining texture integrity during high-moisture extrusion processes.

Success Stories: Implementation in Various Industry Segments

Midwest Beef Processors demonstrated exceptional ROI after installing automated cutting machinery, decreasing processing time per carcass from 38 minutes to 21 minutes and reducing waste by 19% through precision cutting paths. Their integrated tracking system automatically records yield data against each animal ID, enabling premium pricing for verified quality cuts. Ocean's Finest Seafood installed cryogenic grinding systems allowing processing throughput increases to 3.8 tonnes per hour while maintaining core temperatures below 1°C. This enabled compliance with FDA's seafood HACCP requirements while expanding distribution range by 500 kilometers. Poultry producers benefited most from modern equipment used in meat industry applications - automated deboning systems recover up to 5% more breast meat compared to manual operations. The installation cost of $2.4 million delivered payback in 14 months through labor savings and increased yield valuation.

Navigating Regulatory Compliance and Safety Standards

Equipment used in meat industry facilities must adhere to rigorous international standards including EN 1672-2 design principles for food machinery safety. Material certifications require full traceability back to smelting certifications, with documentation verifying composition and surface treatments. Contemporary designs incorporate triple-pass verification systems: mechanical interlocks prevent operation during maintenance, RFID tags detect unauthorized access, and pressure sensors halt operation if guarding is compromised. Electrical components must meet NEMA 4X or IP69K ratings for wet environments, tested to withstand water ingress during high-pressure cleaning cycles exceeding 1,200 PSI. Recent OSHA data indicates compliant processing equipment reduced machine-related injuries by 74% between 2015-2022. Meat industry machinery suppliers must maintain comprehensive technical files documenting compliance with NSF/3-A sanitary standards and EC1935/2004 food contact material regulations.

Investing in the Future of Equipment Used in the Meat Industry

Industry investments now prioritize two technological trajectories: nanotechnology applications in non-stick surfaces and AI-enhanced predictive maintenance systems. Nano-coatings on cutting blades have demonstrated friction reductions up to 78%, decreasing energy consumption while extending sharpness longevity by 140%. Vision systems integrated with deep learning algorithms now identify product defects beyond human detection, achieving 99.4% accuracy in marbling analysis and early contamination identification. Production scheduling systems incorporate machine learning processing historical demand patterns, weather data, and commodity prices to optimize daily production schedules with 97% forecast accuracy. The next generation of industry meat mincer prototypes utilize microwave-assisted grinding which reduces bacterial growth by maintaining temperatures below 4°C during operation. Facilities adopting these technologies report 16% lower utility expenses and 28% reduction in maintenance costs versus conventional operations over a five-year operating period.

(meat industry machinery)

FAQS on meat industry machinery

Q: What are the common types of machinery used in the meat industry?

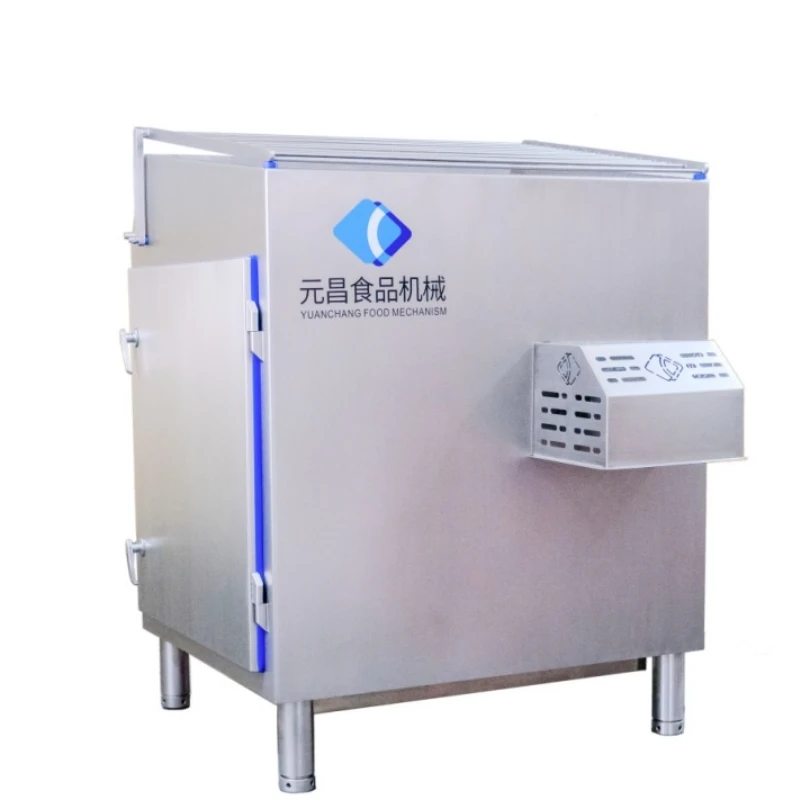

A: Common machinery includes industrial meat mincers, slicers, mixers, grinders, and packaging equipment. These machines streamline processing, enhance efficiency, and ensure food safety standards. Advanced systems may also integrate automation for precision.

Q: How does an industrial meat mincer improve meat processing?

A: An industrial meat mincer accelerates meat breakdown, ensuring consistent texture for products like sausages or burgers. It reduces labor costs and meets high-volume production demands. Modern mincers also feature adjustable settings for varied output sizes.

Q: What safety standards apply to meat industry equipment?

A: Equipment must comply with food safety regulations like HACCP and FDA/USDA guidelines. Surfaces are typically stainless steel for hygiene and corrosion resistance. Regular sanitization and safety inspections are mandatory to prevent contamination.

Q: How to maintain meat industry machinery for longevity?

A: Routine cleaning, lubrication of moving parts, and replacing worn components (e.g., blades or belts) are critical. Follow manufacturer guidelines for calibration and software updates. Preventive maintenance reduces downtime and extends machine lifespan.

Q: What innovations are shaping meat industry machinery today?

A: Trends include AI-driven automation, energy-efficient designs, and IoT-enabled monitoring for predictive maintenance. Hygienic innovations like antimicrobial coatings and modular equipment setups are also gaining traction. These advancements boost productivity and sustainability.

-

Meat Portioning Machine: Precision, Efficiency & Sustainability in Meat ProcessingNewsNov.24,2025

-

Discover the Benefits of Vacuum Marinating Machines for Efficient Food ProcessingNewsNov.24,2025

-

The Ultimate Guide to Commercial Chicken Scalders: Efficiency, Sustainability & InnovationNewsNov.23,2025

-

Chicken Harvesting Equipment: Efficient & Humane Solutions for Poultry ProducersNewsNov.22,2025

-

Comprehensive Guide to Meat Processing Plant Equipment | Efficiency, Safety & SustainabilityNewsNov.21,2025

-

Meat Processing Bins: Durable Solutions for Safe & Efficient Meat Handling WorldwideNewsNov.20,2025