- Afrikaans

- Albanian

- Amharic

- Arabic

- Armenian

- Azerbaijani

- Basque

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Catalan

- Cebuano

- chinese_simplified

- chinese_traditional

- Corsican

- Croatian

- Czech

- Danish

- Dutch

- English

- Esperanto

- Estonian

- Finnish

- French

- Frisian

- Galician

- Georgian

- German

- Greek

- Gujarati

- haitian_creole

- hausa

- hawaiian

- Hebrew

- Hindi

- Miao

- Hungarian

- Icelandic

- igbo

- Indonesian

- irish

- Italian

- Japanese

- Javanese

- Kannada

- kazakh

- Khmer

- Rwandese

- Korean

- Kurdish

- Kyrgyz

- Lao

- Latin

- Latvian

- Lithuanian

- Luxembourgish

- Macedonian

- Malgashi

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Myanmar

- Nepali

- Norwegian

- Norwegian

- Occitan

- Pashto

- Persian

- Polish

- Portuguese

- Punjabi

- Romanian

- Russian

- Samoan

- scottish-gaelic

- Serbian

- Sesotho

- Shona

- Sindhi

- Sinhala

- Slovak

- Slovenian

- Somali

- Spanish

- Sundanese

- Swahili

- Swedish

- Tagalog

- Tajik

- Tamil

- Tatar

- Telugu

- Thai

- Turkish

- Turkmen

- Ukrainian

- Urdu

- Uighur

- Uzbek

- Vietnamese

- Welsh

- Bantu

- Yiddish

- Yoruba

- Zulu

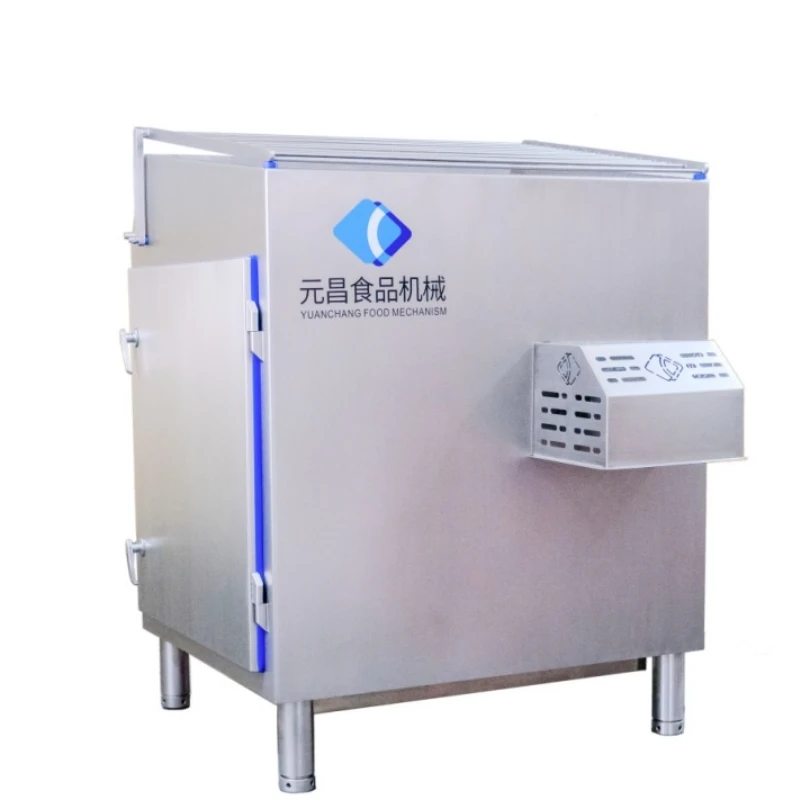

Meat Market Equipment Durable Commercial Processing Solutions

- Market Growth & Industry Data Insights

- Technological Advancements in Processing Systems

- Comparative Analysis of Leading Equipment Manufacturers

- Customized Solutions for Operational Demands

- Implementation Case Studies Across Sectors

- Future Trends Shaping Equipment Development

- Strategic Selection of Meat Market Equipment

(meat market equipment)

Meat Processing Equipment Market Growth & Industry Data Insights

The global meat processing equipment market is projected to reach $14.8 billion by 2029, growing at a 5.2% CAGR (2024-2029). This expansion directly correlates with:

- 28% increase in automated deboning system adoption since 2021

- 41% reduction in energy consumption with modern slicing systems

- 17% annual growth in poultry-specific processing solutions

Technological Advancements in Processing Systems

Modern meat and poultry processing equipment integrates three critical innovations:

- AI-powered yield optimization systems (4-6% waste reduction)

- Multi-spectral contamination detection (99.97% accuracy)

- Self-sanitizing hydraulic circuits (38% faster cleaning cycles)

Comparative Analysis of Leading Manufacturers

| Manufacturer | Core Technology | Throughput (kg/h) | Energy Class |

|---|---|---|---|

| ProteinMaster | Adaptive portion control | 2,400 | AAA+ |

| Carnotech | Hybrid pneumatic cutting | 1,850 | AA+ |

| AgriProcess Pro | Modular automation | 3,100 | AAA |

Customized Solutions for Operational Demands

Specialized configurations address specific production needs:

- High-volume processors: 360° cryogenic chilling tunnels (-42°C capability)

- Artisanal producers: Compact multi-function units (14 processing modes)

- Export-focused facilities: Dual-standard compliance systems

Implementation Case Studies Across Sectors

A Midwest beef processor achieved:

- 19% increase in prime cut recovery

- 22-month ROI on $2.4M equipment investment

- 37% reduction in water consumption

Future Trends Shaping Equipment Development

Emerging technologies driving next-gen meat market equipment

:

- Blockchain-integrated traceability modules

- Predictive maintenance AI (85% failure pre-detection)

- Hydrogen-powered processing lines

Strategic Selection of Meat Processing Equipment

Operators should evaluate:

- Throughput scalability (minimum 25% headroom)

- Compliance adaptability (3+ regulatory frameworks)

- Total lifecycle costs (15-year operational horizon)

(meat market equipment)

FAQS on meat market equipment

Q: What are the key components of meat processing equipment market?

A: The market includes grinders, slicers, mixers, and packaging systems. Advanced automation and food safety compliance drive demand. Key players focus on energy-efficient and hygienic designs.

Q: How does meat market equipment improve processing efficiency?

A: Automated systems reduce labor costs and minimize human error. Precision tools ensure consistent product quality and faster throughput. Modular designs allow scalability for small to large operations.

Q: What trends shape the meat and poultry processing equipment market?

A: Sustainability drives demand for water/energy-saving technologies. Smart IoT-enabled devices enable real-time monitoring. Rising poultry consumption boosts specialized equipment innovation.

Q: What factors should buyers consider when selecting meat processing equipment?

A: Prioritize compliance with food safety regulations like USDA/FSIS. Evaluate maintenance costs and spare part availability. Assess scalability to accommodate future production growth.

Q: How is technology transforming meat market equipment?

A: AI-powered systems optimize cutting yields and reduce waste. Robotics enhance packaging speed and precision. Blockchain integration improves traceability in supply chains.

-

Vacuum Bowl Cutter ZKZB-125: Food Processing Machine&304 Stainless SteelNewsAug.15,2025

-

Vacuum Bowl Cutter ZKZB-125 - Hebei Yuanchang | Meat Processing, Pet FoodNewsAug.15,2025

-

Precision Sausage Cutting Machine | Efficient Slicer for FoodNewsAug.15,2025

-

Vacuum Bowl Cutter ZKZB-125 - Hebei Yuanchang Food Mechanism & Technology Co., Ltd.NewsAug.15,2025

-

Vacuum Bowl Cutter ZKZB-125 | Hebei Yuanchang: Meat & Pet Food ProcessingNewsAug.15,2025

-

Vacuum Bowl Cutter ZKZB-125-Hebei Yuanchang Food Mechanism & Technology Co., Ltd.|Food Processing Technology,Vacuum ProcessingNewsAug.14,2025