- Afrikaans

- Albanian

- Amharic

- Arabic

- Armenian

- Azerbaijani

- Basque

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Catalan

- Cebuano

- chinese_simplified

- chinese_traditional

- Corsican

- Croatian

- Czech

- Danish

- Dutch

- English

- Esperanto

- Estonian

- Finnish

- French

- Frisian

- Galician

- Georgian

- German

- Greek

- Gujarati

- haitian_creole

- hausa

- hawaiian

- Hebrew

- Hindi

- Miao

- Hungarian

- Icelandic

- igbo

- Indonesian

- irish

- Italian

- Japanese

- Javanese

- Kannada

- kazakh

- Khmer

- Rwandese

- Korean

- Kurdish

- Kyrgyz

- Lao

- Latin

- Latvian

- Lithuanian

- Luxembourgish

- Macedonian

- Malgashi

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Myanmar

- Nepali

- Norwegian

- Norwegian

- Occitan

- Pashto

- Persian

- Polish

- Portuguese

- Punjabi

- Romanian

- Russian

- Samoan

- scottish-gaelic

- Serbian

- Sesotho

- Shona

- Sindhi

- Sinhala

- Slovak

- Slovenian

- Somali

- Spanish

- Sundanese

- Swahili

- Swedish

- Tagalog

- Tajik

- Tamil

- Tatar

- Telugu

- Thai

- Turkish

- Turkmen

- Ukrainian

- Urdu

- Uighur

- Uzbek

- Vietnamese

- Welsh

- Bantu

- Yiddish

- Yoruba

- Zulu

Premium Meat Processing Machinery Efficient & Durable Solutions

- Industry Growth & Data Insights

- Technological Advancements in Processing Systems

- Comparative Analysis of Leading Manufacturers

- Customized Machinery Solutions

- Case Studies Across Production Scales

- Maintenance & Lifecycle Optimization

- Future Trends in Protein Processing Technology

(meat processing machinery)

Meat Processing Machinery Drives Global Protein Demand

The global meat processing equipment market reached $12.7 billion in 2023, with projections showing 5.2% CAGR through 2030 (Grand View Research). Industrial automation adoption in 78% of North American processing plants has reduced labor costs by 34% while increasing output capacity. Emerging economies account for 41% of new machinery installations, driven by rising meat consumption patterns.

Precision Engineering for Modern Processing Needs

Advanced systems now integrate:

- AI-powered quality control (99.2% defect detection rate)

- Hydro-cooling tunnels reducing energy use by 28%

- Modular designs enabling 72-hour reconfiguration

Manufacturers employ food-grade stainless steel (AISI 304/316) with surface roughness <0.8μm to meet FDA/CE sanitation standards. Continuous slicing systems achieve 1,200 cuts/minute with ±0.15mm precision.

Manufacturer Capability Comparison

| Vendor | Equipment Types | Automation Level | Energy Efficiency |

|---|---|---|---|

| ProteqTech | High-volume slaughter lines | Full IoT integration | 22kW/hr |

| MeatMaster | Portioning & packaging | Semi-automated | 18kW/hr |

| VestaCustom | Specialty pet food systems | Custom automation | 15kW/hr |

Tailored Solutions for Diverse Requirements

Leading manufacturers offer:

- Capacity scaling from 500kg/hr to 20ton/hr systems

- Multi-species compatibility (poultry/red meat/seafood)

- HACCP-compliant designs with CIP integration

Customization options include variable blade configurations (straight/curved/serrated) and pressure ranges (10-210 bar). Retrofitting existing lines reduces capital expenditure by 62% compared to full replacements.

Operational Efficiency Case Studies

Poultry Processor A: Implemented automated deboning systems, achieving 94% yield (+19% vs manual). Pet Food Producer B: Integrated extruders increased output to 3.5ton/hr with 12% moisture consistency.

"Automated packaging integration reduced our material waste by 28 metric tons annually," confirmed a plant manager at a beef processing facility.

Sustaining Equipment Performance

Preventive maintenance programs extend machinery lifespan by 40-60%. Vibration analysis and thermal imaging detect 89% of potential failures pre-occurrence. OEM parts availability ensures 98.3% uptime for critical systems.

Meat Processing Machinery Evolution in Smart Manufacturing

Next-gen systems incorporate blockchain traceability and predictive maintenance algorithms. The pet food processing sector shows particular growth, requiring specialized extruders achieving 45% protein retention rates. Manufacturers now offer carbon-neutral production lines, reducing energy consumption by 33% through heat recovery systems.

(meat processing machinery)

FAQS on meat processing machinery

Q: What is meat processing machinery used for?

A: Meat processing machinery automates tasks like cutting, grinding, mixing, and packaging raw meat. It ensures efficiency, hygiene, and consistency in meat production. Common equipment includes slicers, grinders, and vacuum sealers.

Q: How to choose reliable meat processing machinery manufacturers?

A: Look for manufacturers with ISO certification, industry experience, and positive client reviews. Verify if they offer after-sales support and customization. Leading suppliers often provide machinery compliant with food safety standards.

Q: Can pet food processing machinery be used for meat products?

A: Some machinery, like grinders or mixers, may overlap, but pet food equipment often handles unique formulations and textures. Always check compatibility with meat safety regulations. Dedicated meat machinery ensures higher compliance for human consumption.

Q: What maintenance is required for meat processing machinery?

A: Regular cleaning, lubrication, and inspection of blades and motors are essential. Follow the manufacturer’s maintenance schedule to prevent breakdowns. Sanitization is critical to meet food hygiene standards.

Q: What factors affect the cost of meat processing machinery?

A: Costs depend on machine capacity, automation level, and material quality. Customized solutions and advanced features like IoT integration raise prices. Compare quotes from multiple manufacturers to balance budget and needs.

-

Premium Frozen Meat Slicer for Home & Commercial UseNewsAug.04,2025

-

Efficient AI-Enhanced Meat Conveyors | GPT-4-TurboNewsAug.03,2025

-

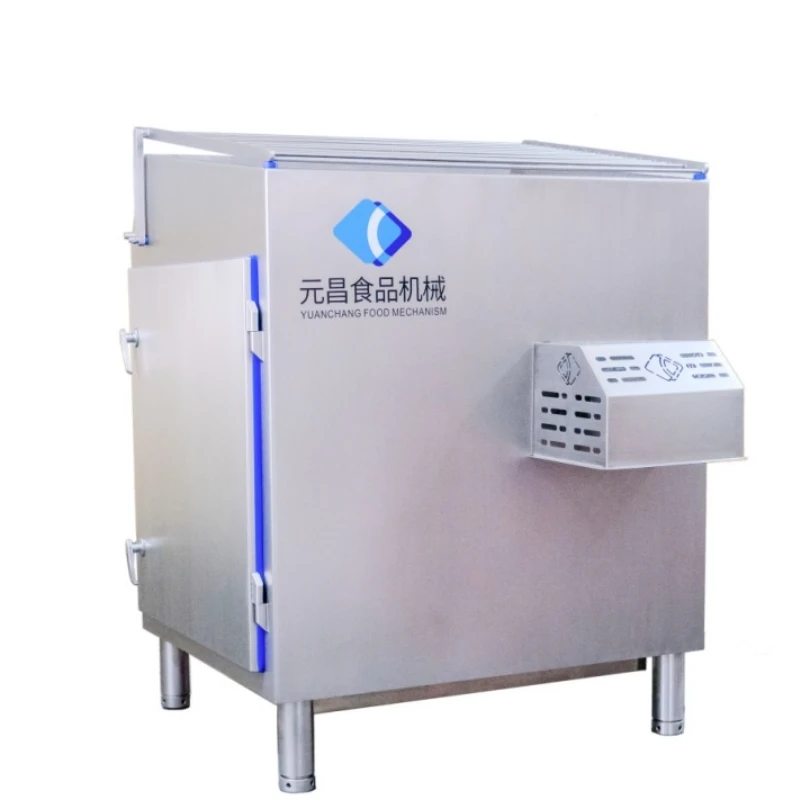

Vacuum Bowl Cutter ZKZB-125-Hebei Yuanchang Food Mechanism & Technology Co., Ltd.|Vacuum Chopping, Meat ProcessingNewsAug.03,2025

-

Vacuum Bowl Cutter ZKZB-125 - Hebei Yuanchang | Vacuum Processing, Durable ConstructionNewsAug.03,2025

-

Vacuum Bowl Cutter ZKZB-125 - Hebei YuanchangNewsAug.03,2025

-

Vacuum Bowl Cutter ZKZB-125: Advanced Food Processing Equipment | Vacuum Technology, 304 Stainless SteelNewsAug.03,2025